Should You Include 529 Plans in Your Benefits Offerings?

July 14, 2017

By George Makras, director of institutional relationship management at Ascensus College Savings

Now is the time when many employers begin evaluating their benefits offerings in anticipation of open enrollment. In today’s competitive job market, benefits play an important role in attracting and maintaining employees. Offering a 529 plan to your employees through payroll direct deposit can be a great addition to a comprehensive benefits package.

You can offer access to a 529 plan through payroll direct deposit at no cost. For as little as $15 per pay period, your employees can save for their children’s and grandchildren’s future education. They can even save for their own re-training and career development. In many states, onsite support is also available, making it even easier for employers to incorporate college savings in their financial wellness programs and benefit offerings.

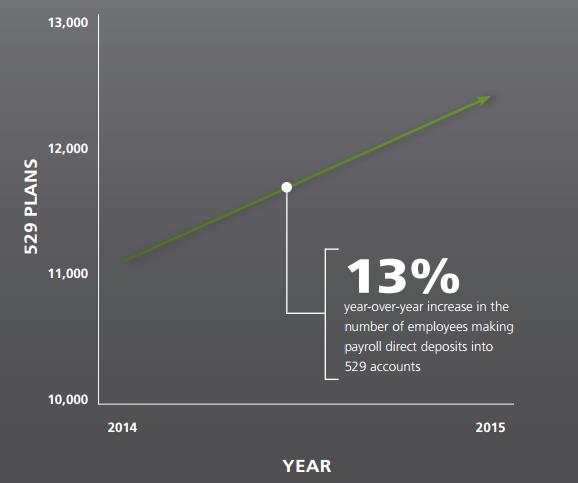

The convenience of payroll is evident as more employees are opting to establish payroll direct deposit into their 529 accounts, making small contributions with each payroll cycle. In our most recent college savings trends report, we saw a 13% year-over-year increase in the number of employees making payroll direct deposits into 529 accounts.1 This approach can make the 529 investment process automatic, simple, and easier to manage over time.

Getting your questions answered is as easy as emailing us at 529employer@ascensus.com. Our team can help you make a plan to get a competitive edge.

1Ascensus College Savings Platform, as of December 31, 2016.